Render is Not Nvidia. It is Airbnb for Robots.

The market is pricing a hardware monopoly. The chain reveals a commodity marketplace with a 4.4x inflation gap.

PREEMINENCE SUMMARY

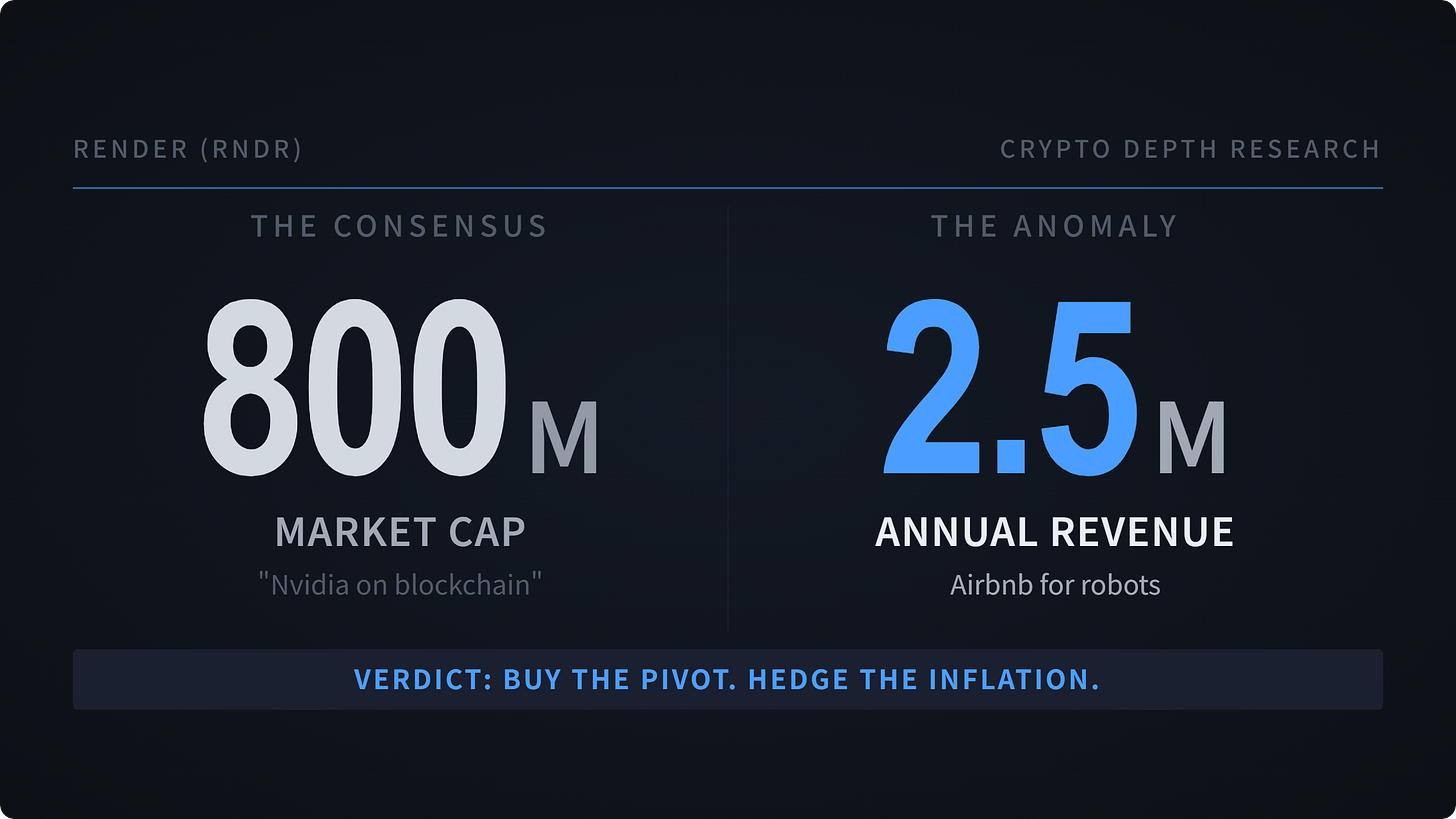

The Consensus: Retail believes it is buying “Nvidia on blockchain.” 67 million lifetime frames. 5,600 nodes. The word “compute.” Cognitive shutdown.

The Anomaly: Market cap north of $800M. Annual revenue $2.5M. Direct competitor io.net running 8x the cash flow. The BME is bleeding a +380,000 RENDER monthly structural deficit. This is not a deflationary asset. It is an inflationary instrument on life support via subsidies.

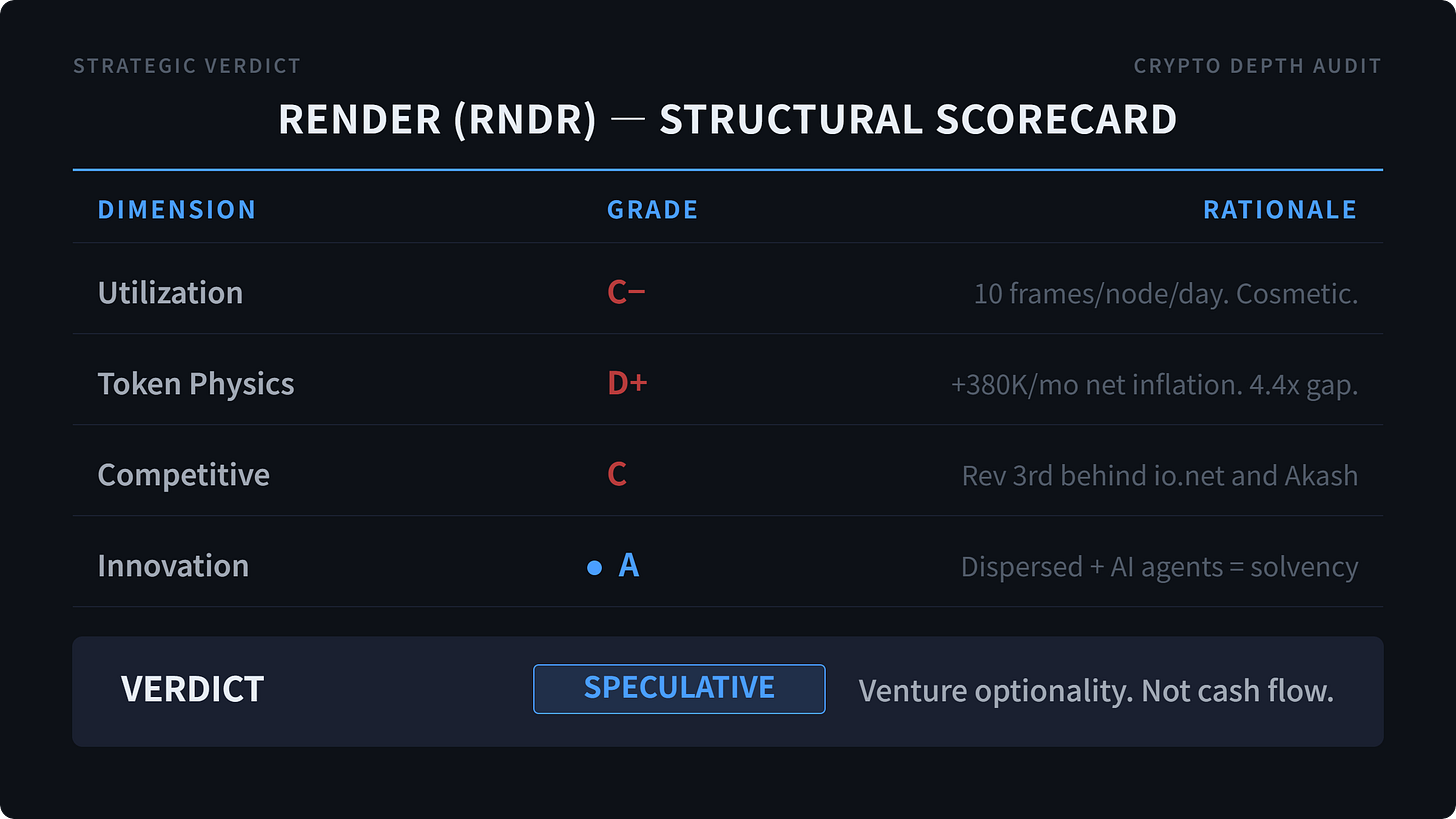

The Verdict: SPECULATIVE ACCUMULATION. Not a value position. A venture bet that the AI Agent economy reaches escape velocity before the emissions schedule drowns the float. Buy the pivot. Hedge the inflation.

1. The Utilization Gap — 5,600-Room Resort, Single-Digit Occupancy

Render calls itself “the backbone of the AI compute revolution.” The backbone is asleep most of the time.

Numbers. Q3 2025 throughput: approximately 5.4 million frames. Quarter-over-quarter increase: 13%. Daily run rate: 60,000 frames. Divide by 5,600 nodes. 10 frames per node per day. Against GPUs capable of spitting out frames in seconds, this is the computational equivalent of driving an F1 car to the corner store for a carton of milk.

Reports claim 85–95% node utilization. The figure evaporates on contact with emissions data. If 95% of nodes were processing paid workloads, the payout structure would be dominated by Job Rewards. Reality. The BME framework remains heavily skewed toward Availability Rewards — payments made to node operators for the act of existing. They are not earning because they work. They are earning because they breathe. This is not utilization. It is a participation trophy with a token attached.

Visualize it. Theoretical capacity: 5,600 GPU nodes. Actual consumed compute: 60,000 frames per day. The void between those two numbers is the gap between a hotel’s room count and its occupancy rate. A 5,600-room resort running at what appears to be single-digit real occupancy. The cost of empty rooms is not covered by guests. It is covered by subsidies.

Structural Implication: The “Burn” side of the BME is structurally dysfunctional. Without a dramatic surge in real workloads, the sole force supporting the token price is narrative resonance (Vector 2) — the most fragile in the hierarchy. A toll booth with zero traffic is just concrete.

🔓 INSTITUTIONAL ACCESS: UNLOCKED [BETA]

The following forensic audit is normally reserved for Paid Subscribers (Institutional Tier). During the “Crypto Depth” launch period, we have temporarily removed the Paywall. Proceed below to access the Unit Economics & Valuation Models.

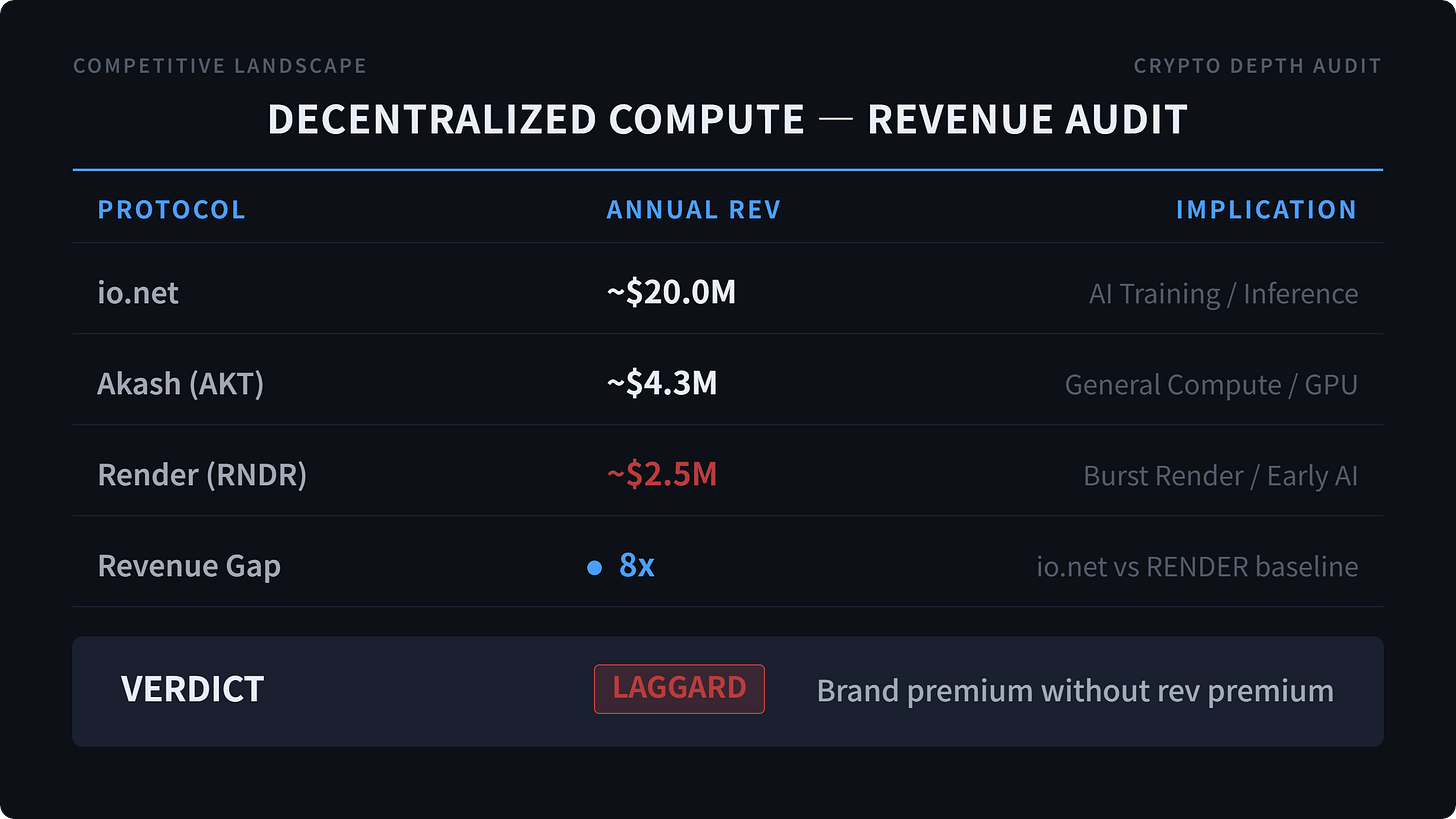

2. The Revenue Disparity — Leader Pricing, Laggard Earnings

On-chain annualized revenue: approximately $2.5M. The “record-breaking” month of December 2025: 120,118 RENDER burned. Dollar equivalent: roughly $169,000. Prior months consistently registered in the 15,000–50,000 RENDER range. The $2.5M annualized figure is generous.

The competitive landscape. The numbers are unflattering.

The most recognized brand in decentralized compute sits at the bottom of the revenue table. io.net delivers 8x the cash flow. Akash clears 1.7x. These are ledger facts.

The structural cause is unambiguous. Render was architected for burst rendering — short-duration, high-intensity frame processing for 3D artists. A niche workload. io.net and Akash targeted general-purpose compute and AI training from genesis. Long-duration. Sticky. Sustained revenue. Render built a Michelin three-star kitchen. The market wanted a 24-hour cafeteria.

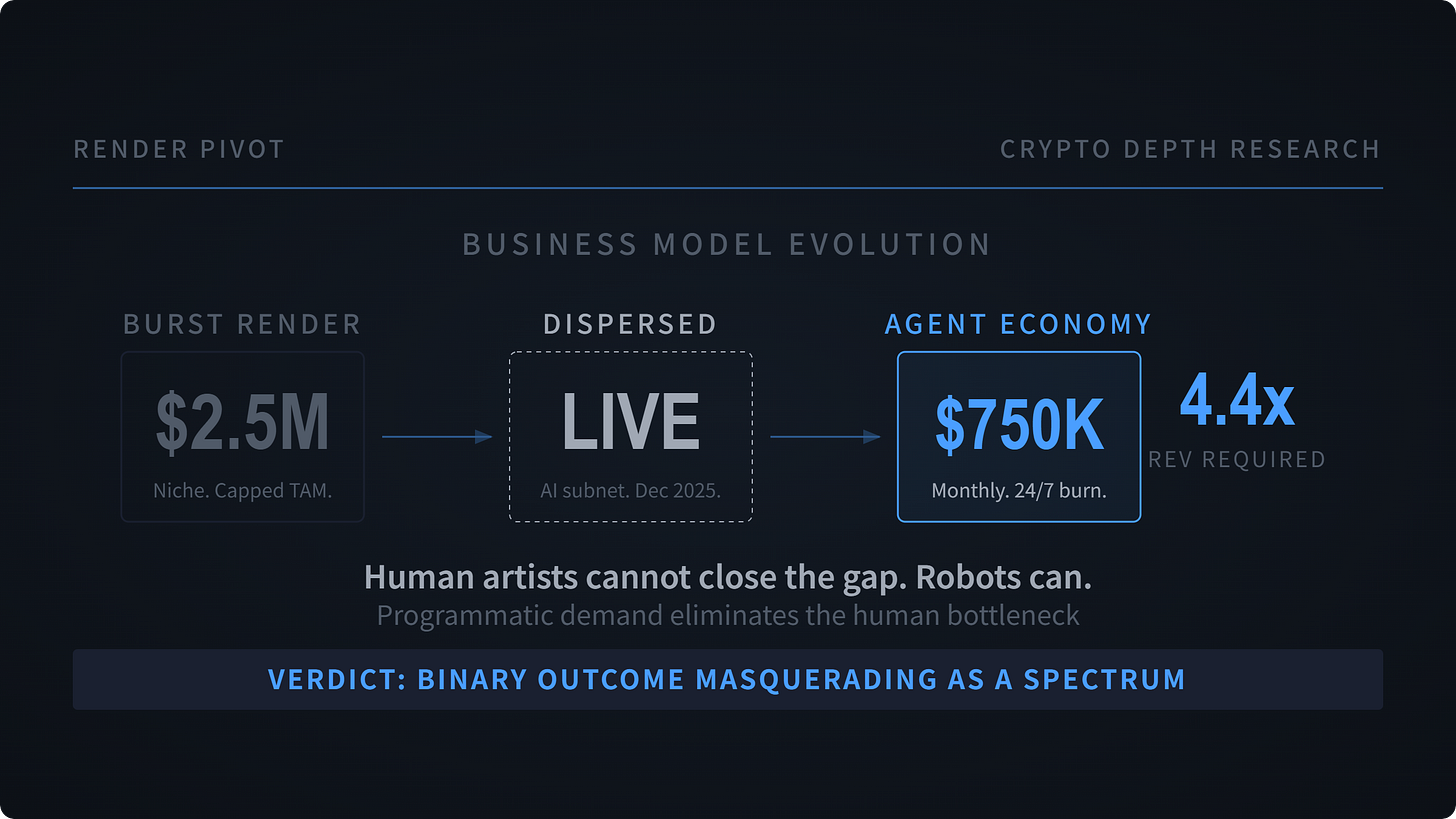

Render itself has confirmed the diagnosis. The December 2025 launch of Dispersed — a dedicated AI compute subnet — is a de facto capitulation: an admission that the artist rendering market alone cannot sustain the token economics. The pivot to chase io.net’s market share has begun. Pivoting is not inherently negative. Pivoting from a position of revenue inferiority against an entrenched competitor is an entirely different calculus.

Structural Implication: The market prices RENDER as the category leader. The ledger confirms category third-place. Brand premium without revenue premium is a narrative tax. Narrative taxes are collected violently during liquidity flushes.

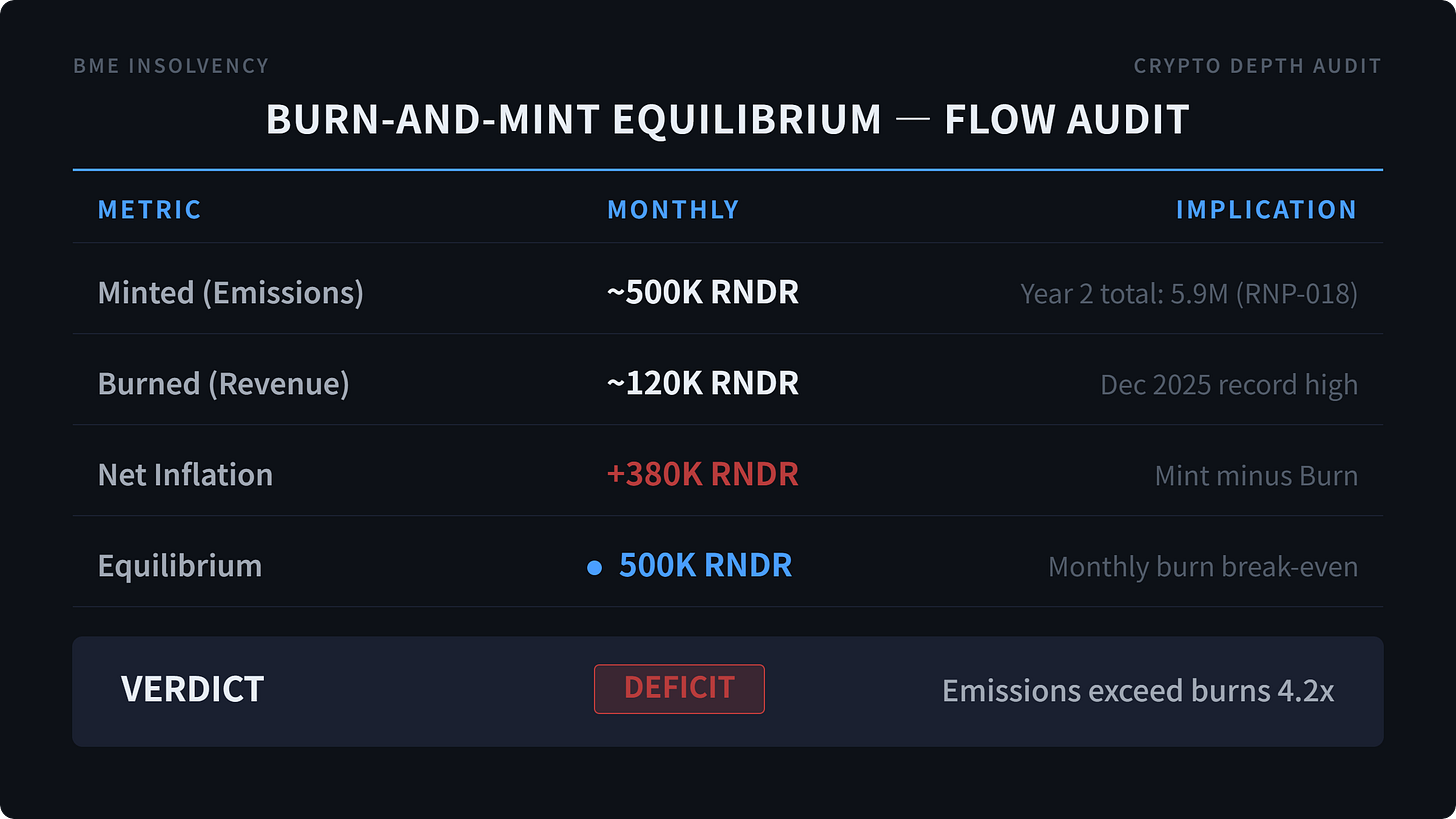

3. BME Insolvency — The Deflationary Engine Running on Fumes

The Burn-and-Mint Equilibrium is elegant in design. Users pay → protocol burns RENDER → new RENDER minted to node operators. Burn equals mint: equilibrium. Burn exceeds mint: deflationary. Burn falls short of mint: inflationary. Render is deep on the inflationary side. The ledger leaves no room for ambiguity.

The emissions schedule is governed by community proposals. RNP-006 authorized 9.1M RENDER in Year 1. RNP-018 cut it to 5.9M in Year 2. The trajectory is declining. In theory, the equilibrium threshold drops with it.

But reflexive risk kicks in. Cut node subsidies before organic demand fills the void and you trigger an operator exodus. Render is running a chicken race between revenue growth and subsidy decay. If both sides do not brake simultaneously, they collide.

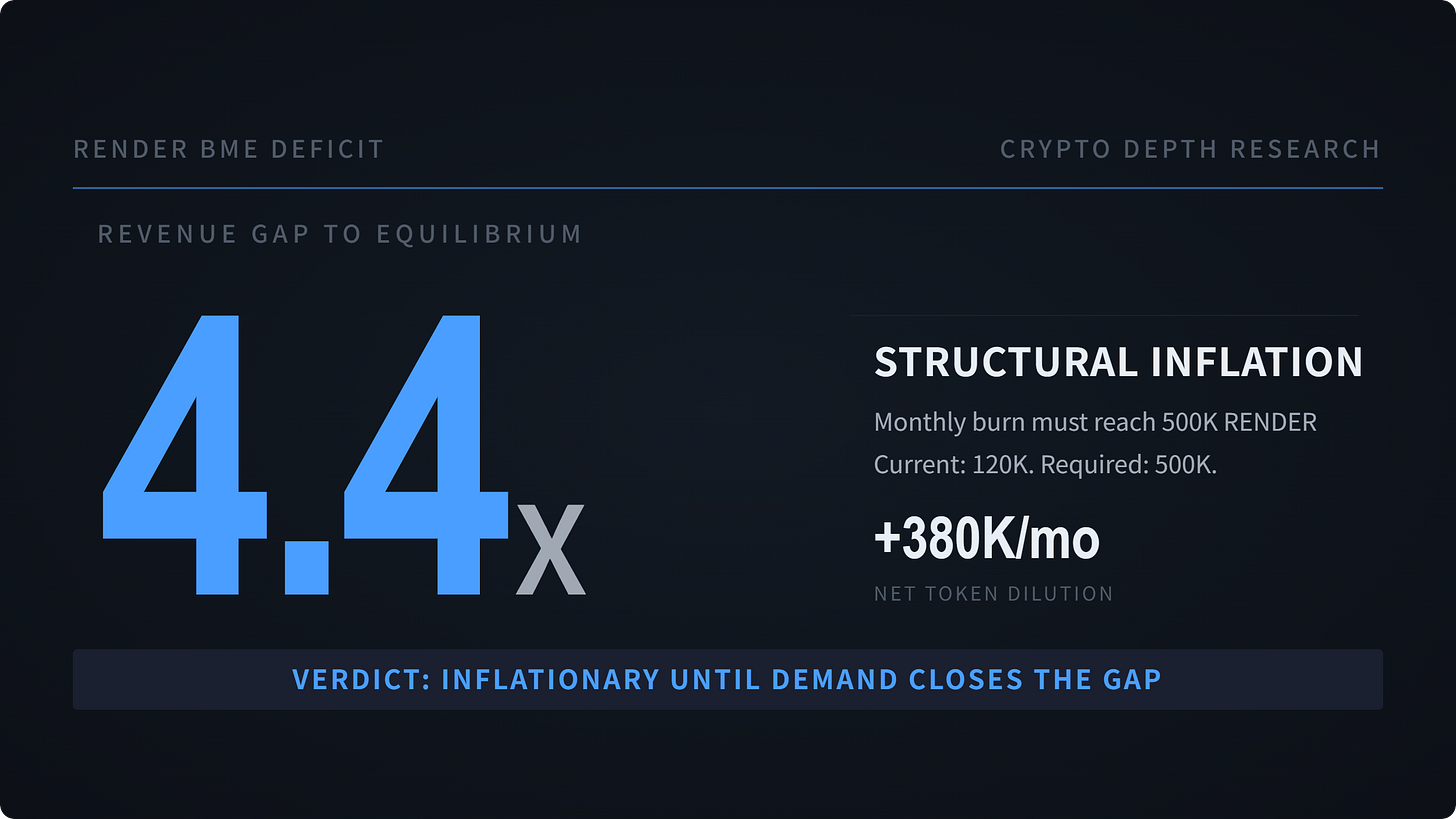

The “deflationary asset” marketing is, at present, fiction. Until monthly revenue reaches $750,000 — a 4.4x increase from the current all-time high — every month injects approximately 380,000 tokens of net dilution into the float. Holders are not accumulating a scarce commodity. They are paying the operating costs of an underutilized network out of their own pockets.

Structural Implication: Revenue must grow 4.4x before RENDER stops diluting its holders. The full weight of the investment thesis rests on a single assumption: AI demand closes the gap before emissions erode per-unit token value. Not a cash-flow position. A race condition. The clock is already running.

What you are holding right now is a subsidy receipt disguised as a compute commodity. The BME is underwater. Utilization is cosmetic. But there is one vector — exactly one — that rewrites the arithmetic from the ground up. The AI Agent economy is either Render’s salvation or its eulogy. The forensic audit of the pivot lies beyond this line.

Retail pays for logos. Institutions pay for ledgers. This is the ledger.

4. The Agent Pivot — The Last Card on the Table

Human artists cannot close the 4.4x revenue gap. The arithmetic refuses.

Humans sleep. Humans have budget constraints. Humans negotiate. The TAM for burst rendering — Marvel-grade VFX, architectural visualization, motion graphics — has a hard ceiling. Render has not even reached that ceiling. 60,000 frames per day against 5,600 nodes. Not a capacity problem. A demand problem.

The pivot target: AI Agents. Autonomous programs that procure compute programmatically, continuously, with zero friction coefficient from human sales cycles. Not incremental growth. Business model replacement.

Dispersed (launched December 2025) is the infrastructure for this bet. Thousands of GPUs aggregated into a dedicated subnet for AI training, inference, and general compute. Fully segregated from the legacy rendering pipeline. The entry ticket to fight AWS, Azure, and io.net in the same ring.

The endgame. Real-time bidding for compute. AI agents broadcast bids (”100 H100-hours at $2.00/hr”) → Solana smart contracts match to available nodes → payment locked in RENDER or USDC → job executed → protocol cut burned. Human-in-the-loop: zero. Sales team: unnecessary. Sleep cycle: irrelevant. 24/7 burn generation. If it works.

The bull case. Programmatic demand eliminates the human bottleneck capping the rendering market. A single developer spawns 1,000 inference agents. Each demands GPU cycles. Generates more sustained burn than an entire VFX studio. The burn mechanics are real. The demand is speculative.

The bear case. Automated compute procurement commoditizes hardware margins. If AI agents optimize purely on price, the race to the bottom compresses Render’s take rate to near-zero. AWS and Azure carry SLA guarantees that a decentralized network of idle consumer GPUs cannot match. The same programmatic logic that could save Render could bypass it entirely.

Structural Implication: The Agent economy is the sole vector capable of generating the $750K monthly revenue required for BME equilibrium. Human artists are arithmetically insufficient. If Dispersed + Prime Intellect + Scrypted deliver programmatic demand by Q3 2026 — the burn mechanics activate and the token transitions from inflationary subsidy to deflationary commodity. If they do not — the +380,000 RENDER monthly structural deficit compounds against a shrinking narrative premium. A binary outcome masquerading as a spectrum.

5. The Strategic Verdict

Render is not “Nvidia on blockchain.” Nvidia manufactures scarcity. Proprietary chips. IP. Supply chain chokepoints. Render manages surplus. Other people’s idle GPUs. Price competition against hyperscalers with infinite balance sheets. One creates bottlenecks. The other tries to fill them. The comparison is not inaccurate. It is financially illiterate.

Render is Airbnb for robots. And like Airbnb, fate is determined by occupancy rates, not room counts. Current state: 5,600 rooms. Real occupancy in the single digits. Competitor io.net running 8x the cash flow on less brand recognition.

The Scorecard

The Directive

Rating: SPECULATIVE ACCUMULATION — Buy the pivot. Hedge the inflation.

This is not conviction-hold sizing. This is call-option sizing. Defined risk. Asymmetric payoff. Time decay working against you.

If (Upside): AI agents begin autonomously procuring decentralized compute at scale by Q3 2026 → monthly burns breach the 500K RENDER threshold → BME flips deflationary → token reprices violently upward off a base of suppressed sentiment and institutional neglect.

If (Downside): The Agent economy routes to AWS, Azure, or io.net → Dispersed fails to attract sticky programmatic workloads → the +380K RENDER monthly structural deficit compounds → narrative premium evaporates → token converges toward revenue-justified valuation. At $2.5M annual revenue, that is a fraction of the current market cap.

The punchline is always the same. You are not buying a compute monopoly. You are buying a lottery ticket on the thesis that robots will rent GPUs from strangers on the internet instead of from Amazon. The thesis might be correct. Price accordingly.

Final Note: The “Casino Era” rewarded conviction. The “Physics Era” rewards arithmetic. Render’s arithmetic: inflationary, underutilized, competitively outgunned — yet holding the one option (AI Agent demand) that rewrites every variable simultaneously. The framework is complete. The bet is yours.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investing in crypto assets carries significant risk. All investment decisions are made at your own discretion.